Nepal is gearing up for implementation of Nepal Financial Reporting Standard (Nepalese Version of IFRS). As a part of phase-wise implementation of NFRS in various sector, Insurance companies are moving towards NFRS convergence after multinational public companies and Banks and Financial Institutions. In this context, here are some key aspects of NFRS convergence specific to insurance sector:

First Time Implementation

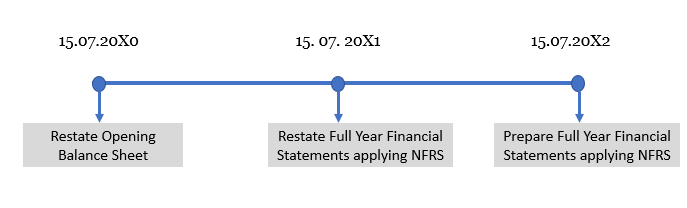

Nepal Financial Reporting Standards 1 required that an entity’s first NFRS compliant financial statements shall include at least three statements of financial position, two statements of comprehensive income, two separate income statements (if presented), two statements of cash flows and two statements of changes in equity and related notes, including comparative information as below:

Components of Financial Statements

Separate Revenue Accounts not required. Revenue and expenses from insurance businesses is consolidated and presented in Statement of Profit & Loss and other comprehensive income.

Accordingly, investment and other income as well as management expenses are not required to be apportioned as Separate Revenue Accounts are not required.

However, management may be required to make additional disclosure of segment profitability in the financial statements under segment reporting requirement.

Liability Determination/Provision for unexpired risk

Liability is required to be determined on the basis of Liability Adequacy Test (LAT) rather than based on fixed percentage of net premium as defined by the regulator.

Actuarial valuation could be used as a basis for LAT.

This shift would impact non-life insurance companies more as life insurance companies in the country are already using actuarial valuation for determining unexpired risk reserves/insurance fund and other solvency margins.

Unbundling of Deposit Components

Some insurance contracts contain both deposit component and Insurance Component, NFRS 4 requires unbundling of those components and treat them separately for financial reporting purpose, when deposit components can be measured separately.

Disclosure Requirement

NFRS requires an insurer to disclose information that identifies and explains the amounts in its financial statements arising form insurance contracts and enables users of its financial statements to evaluate the nature and extent of risks arising from insurance contracts.

Few major disclosure aspects are summarized below:

- Risk Reviews/Risk strategies are required to be disclosed to the shareholders in the annual financial statements.

- Operating Segments: A measure of profit or loss for each reportable segment. Such reportable segments could, most likely, be type of insurance contracts

- Related Party Disclosures

- Retirement Plans and movement in plan assets and liabilities

- Valuation Models and techniques used for deriving Fair Values

- Earnings per share

- Leases

- Intangible Assets and the basis of impairment

- Judgement and estimates made in preparation of financial statements